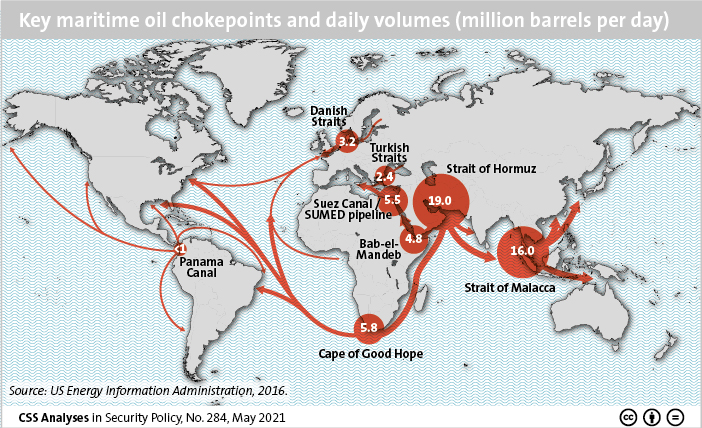

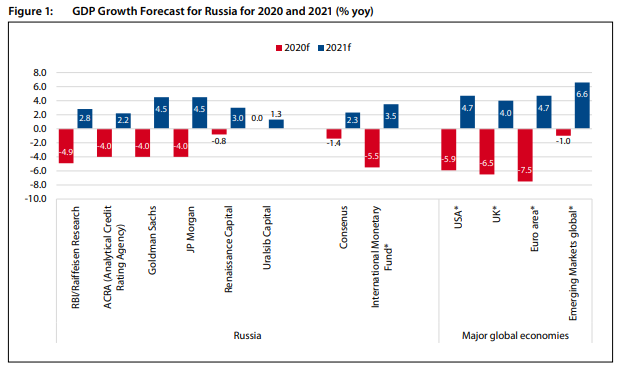

This week’s featured graphic maps key maritime oil chokepoints and daily volumes. For more on the Geostrategic Storm in the Indian Ocean read Boas Lieberherr’s CSS Analysis in Security Policy here.

This week’s featured graphic maps key maritime oil chokepoints and daily volumes. For more on the Geostrategic Storm in the Indian Ocean read Boas Lieberherr’s CSS Analysis in Security Policy here.

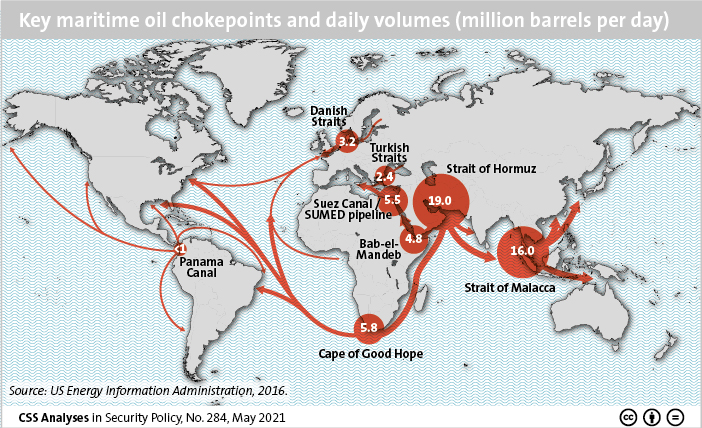

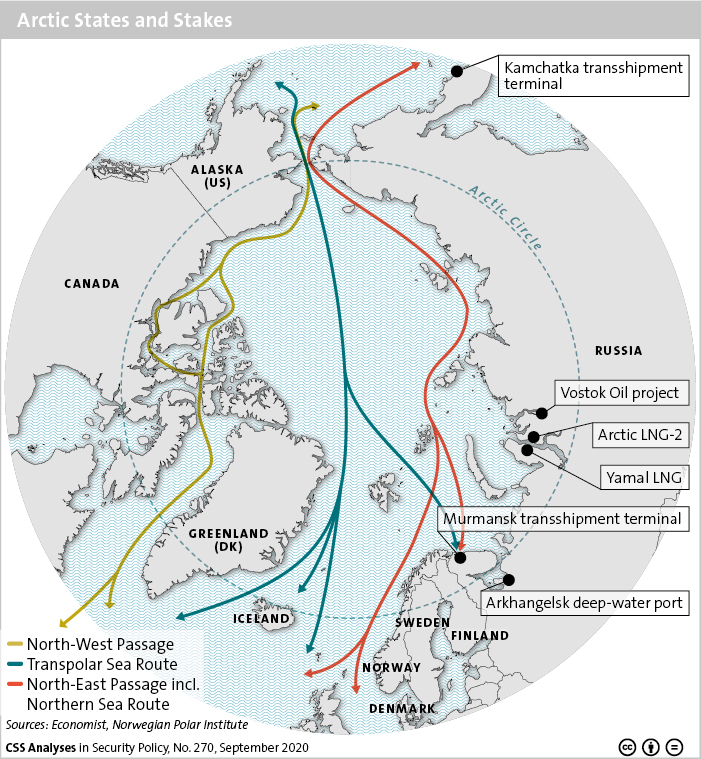

This graphic maps the countries located in the Arctic Circle, as well as its passages and sea routes. In the Arctic, Russia and China have their own ambitions, but their objectives currently overlap. Complementary economic interests are the main driver of their cooperation.

For more on the Sino-Russian dynamics in the Arctic, read Maria Shagina and Benno Zogg’s CSS Analysis in Security Policy here.

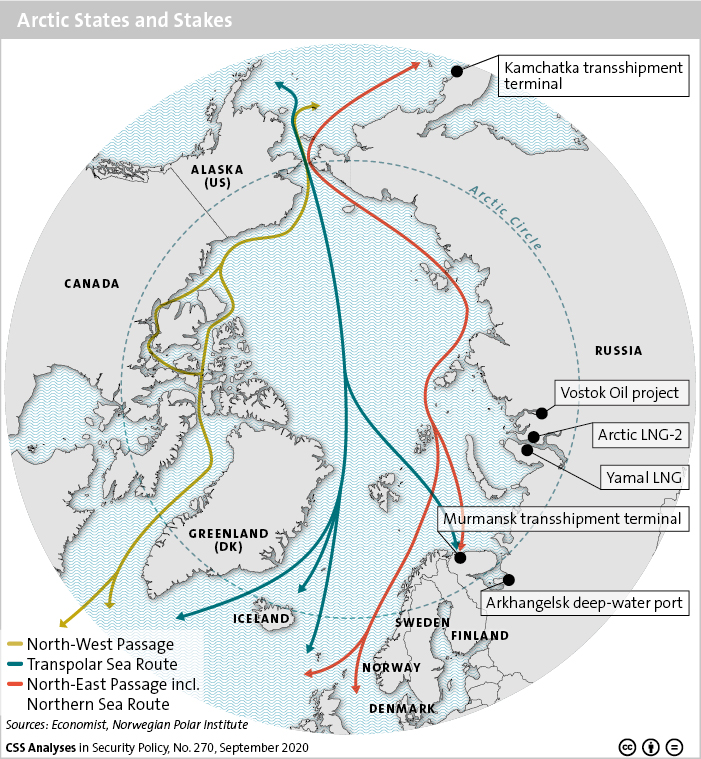

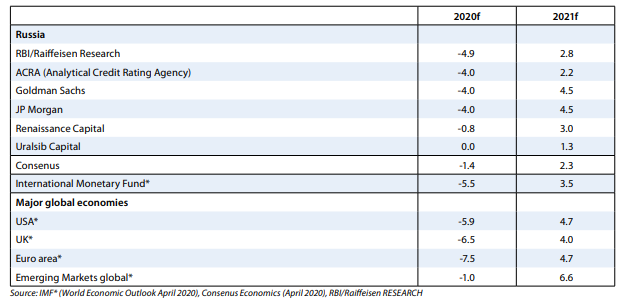

This graphic breaks down the GDP growth forecast for Russia in 2020 and 2021. Forecasts range from slightly negative values to -6 percent. The drastic economic consequences of the quarantine measures explain why 2020 GDP estimates for Russia are currently extremely divergent.

For more on how Russia is facing the economic crisis posed by the Covid-19 pandemic, see Russian Analytical Digest 251 on ‘Russia and the Covid-19 Pandemic’.

This graphic maps the countries located in the Arctic Circle, as well as its passages and sea routes. In the Arctic, Russia and China have their own ambitions, but their objectives currently overlap. Complementary economic interests are the main driver of their cooperation.

For more on the Sino-Russian dynamics in the Arctic, read Maria Shagina and Benno Zogg’s CSS Analysis in Security Policy here.

This article was originally published by Political Violence @ a Glance on 17 September 2019.

Drone attacks allegedly by Houthi rebels this past weekend on the Abqaiq facility and the Khurais oil field effectively knocked out five million barrels of processed crude oil from the world market. If this number doesn’t sound impressive, it amounts to about 5% of the world’s energy supply. Although the Iranian-supported Houthi rebels have been targeting Saudi Arabia in retaliation for their participation in the civil war in Yemen, this attack is different. Knocking out this critical facility will potentially cause prices to rise significantly for almost every commodity due to the reduction of global energy supplies. Since energy influences the price of transportation, which in turn influences the price of food and other commodities, this may cause prices of goods and services of all types to rise globally. Recent estimates suggest that the price of oil may rise from $60 to over $100 per barrel. That is an enormous shock that will be felt worldwide.