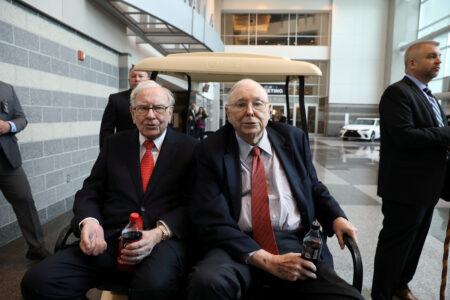

Image courtesy of REUTERS/Scott Morgan, Berkshire Hathaway Chairman Warren Buffett (left) and Vice Chairman Charlie Munger are seen at the annual Berkshire shareholder shopping day in Omaha, Nebraska, U.S., May 3, 2019.

Berkshire Hathaway Inc.’s annual shareholder meeting, which is often called “Woodstock for capitalists,” is an occasion for tens of thousands of the company’s shareholders to descend upon Omaha, Nebraska, to hear famed investor Warren Buffett and his longtime business partner, Charlie Munger, offer their assessments of the company’s recent performance and of broader trends in the economy and politics. This year’s meeting, which convened on May 6, came at a time when aspects of Berkshire’s recent investment strategy have run headlong into a geopolitical storm arising from the intensifying US-China rivalry.

During a recent visit to my home state of Nebraska, I attended the shareholder meeting for the first time. (In the interests of full disclosure, I should mention that I own a few Berkshire Hathaway B shares.) When I wasn’t in the exhibition hall gobbling down a 1 USD Dairy Queen Dilly Bar or stocking up on See’s Candies, both of which are produced by companies that Berkshire owns, I listened to Buffett, the “Oracle of Omaha” who holds a net worth estimated at more than 113 billion USD, join Munger in answering shareholders’ questions for more than five hours.

As a student of China, I was particularly interested in hearing about two of the company’s recent moves. Last fall, Berkshire began selling shares in BYD, a Chinese company that makes electric cars. This selloff has proceeded steadily ever since. Meanwhile, after buying a significant stake in the Taiwan Semiconductor Manufacturing Company (TSMC) during the third quarter of 2022, Berkshire dramatically reduced this position within just a few months. Together, these two moves suggest that Buffett is reluctant to expose his company’s investments to the geopolitical risks associated with rising US-China tensions and, in particular, with the possibility of a war over Taiwan.

A gradual sale of BYD

Buffett, the CEO of Berkshire Hathaway, made his initial investment in BYD in 2008. At that time, BYD was already one of the world’s largest makers of rechargeable batteries. It also had an expanding auto-manufacturing unit and planned to start selling electric vehicles in China and eventually in the United States as well. The MidAmerican Energy Holdings Company, of which Berkshire owned 87.4 per cent, agreed to pay 230 million USD for a 9.89 per cent stake in BYD.

BYD has grown rapidly in recent years. This growth has occurred overwhelmingly in the Chinese domestic market, but the company has grand ambitions to expand internationally. By the first quarter of this year, BYD’s share of the total electric vehicle market in China, which includes both fully electric vehicles and hybrids, stood at about 45 per cent, up from 30 per cent a year earlier. The company’s share of the overall car market in China is 11 per cent. Although BYD has not yet begun selling electric vehicles in the United States, it has already expanded into a variety of markets around the world and is planning a major push into Europe. BYD already sells more total electric vehicles globally than Tesla and is positioning itself to surpass Tesla in global sales of fully electric vehicles as well.

By July 2022, Berkshire’s stake in BYD was worth 9.5 billion USD. Berkshire owned 225 million shares of the Hong Kong-listed company, representing a 20.49 per cent stake. Not long afterward, however, Berkshire began to sell. By the beginning of September, Berkshire had sold 3.05 million shares, reducing its holding in the company to 18.87 per cent. Berkshire gradually trimmed its position further, and its stake now stands at less than 10 per cent. On May 8, two days after the shareholder meeting, Berkshire revealed its latest sale of 1.96 million shares worth about 58.9 million USD, a move that reduced its stake in the company from 10.05 per cent to 9.87 per cent.

Buffett was not asked about the sale of BYD shares during the shareholder meeting, and he generally refrains from commenting on his purchases or sales of stock while they are in progress. In April, during a visit to Tokyo in which he announced that Berkshire would increase its stake in Mitsubishi and four other Japanese conglomerates, Buffett gave an interview to CNBC in which he called BYD an “extraordinary” company and said that he was in no hurry to reduce Berkshire’s stake. By selling his shares gradually, Buffett avoids triggering a collapse of the BYD share price or even a crash of the Hong Kong stock exchange. “We’ll find things to do with the money that I’ll feel better about,” he said.

Buffett’s gradual sale of BYD shares could reflect concerns about trends in US-China relations. The US-China rivalry continues to intensify, featuring disputes over Taiwan and technology. Around the time that Berkshire began to sell shares in BYD, these disputes were escalating dramatically. Last August, following Speaker of the House Nancy Pelosi’s visit to Taiwan, China conducted an extensive series of military exercises in the waters and airspace surrounding the island. In October, the United States imposed far-reaching restrictions on the transfer of semiconductor technologies to China, aiming to slow China’s progress in strengthening its military and achieving dominance in advanced sectors of the economy. Many of the digital technologies that enable China’s human rights abuses also rely on advanced semiconductors.

A quick exit from TSMC

Such geopolitical concerns were clearly major factors in Buffett’s decision to withdraw from his investment in TSMC, about which he spoke freely during the shareholder meeting. Taiwan produces more than 60 per cent of the world’s semiconductors and more than 90 per cent of the most advanced ones. TSMC manufactures most of these semiconductors. This semiconductor manufacturing capacity raises the stakes in the dispute over Taiwan. Last August, TSMC chairman Mark Liu said that if China were to invade Taiwan, then the TSMC plant would become inoperable because of its reliance on global supply chains. The resulting disruption to semiconductor supply would greatly exacerbate the economic fallout from an invasion, possibly leading to a severe global recession.

Berkshire purchased a 4.1 billion USD stake in TSMC during the third quarter of 2022, then slashed this position by more than 86 per cent during the fourth quarter. During the shareholder meeting, Buffett called TSMC “one of the best-managed companies and important companies in the world” and said that “there’s nobody in the chip industry that’s in their league, at least in my view.” Buffett, age 92, recalled playing bridge a few years ago with TSMC’s founder, Morris Chang, who is 91. “Marvelous people, marvelous company,” Buffett said.

For Buffett, the company’s location is the problem. If the company were located in the United States, he said, then it would be an ideal investment. TSMC is building a factory in Arizona that is expected to begin production next year. Buffett mentioned that Alleghany Corporation, which Berkshire acquired last year, is participating in the construction of this plant. However, the Arizona facility was apparently not enough to allay Buffett’s concerns. “I feel better about the capital that we’ve got deployed in Japan than Taiwan,” he said. “I wish it weren’t so, but I think that’s the reality, and I re-evaluated that in the light of certain things that were going on.”

The economic consequences of the US-China rivalry

Both Buffett and Munger lamented the current state of US-China relations. Munger, who made the initial recommendation that Berkshire invest in BYD, said that both China and the United States were to blame for the current tension. “I think we’re equally guilty of being stupid,” said Munger, who is 99. “If there’s one thing we should do, it’s get along with China. And we should have a lot of free trade with China—in our mutual interest.” Munger pointed to Apple’s partnership with China as an example of the kind of business that the United States should be doing with China. (Berkshire’s stake in Apple was valued at 151 billion USD at the end of the first quarter, accounting for just under half of the value of Berkshire’s entire stock portfolio.)

Buffett said that US-China tensions create an “enormous problem” and that if the two countries “push it too far, they increase the probability that something really does go wrong.” However, he said that such an outcome is not inevitable. In an ideal vision, he said, the two countries will be competitive, but both will prosper. “I think that the leaders of both countries have got an important job in having that understood and not to do inflammatory things, and we’ll see whether the luck that has taken us from 1945 to present holds out, and I think we can affect to some extent that luck,” he said. Buffett’s recent investment decisions on BYD and TSMC suggest that he is hedging his bets.