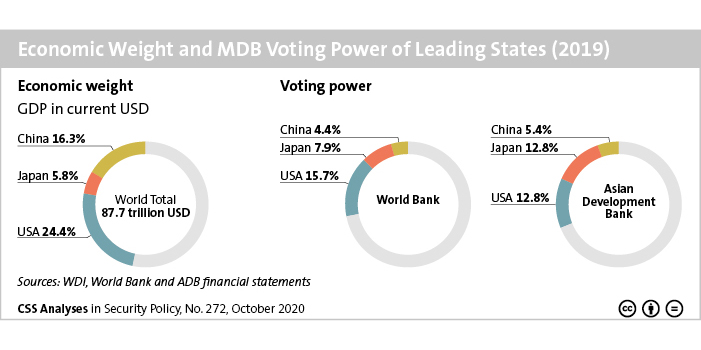

This graphic compares the economic weight of the world’s leading States, as well as their voting power in multilateral development banks (MDB). China has widely funded and built infrastructure in Asia, Africa, and Latin America, and its own national banks play a key role in financing these large-scale projects. However, China’s policy banks also face problems of corruption, poor lending practices and repayment problems. MDBs, by contrast, tend to have higher standards and can help improve the way China engages abroad and shares the risks with other member countries.

For more on how China’s recent foray into multilateral banking brings the country multiple financial and geopolitical benefits, read Chris Humphrey & Linda Maduz’s CSS Analysis in Security Policy here.