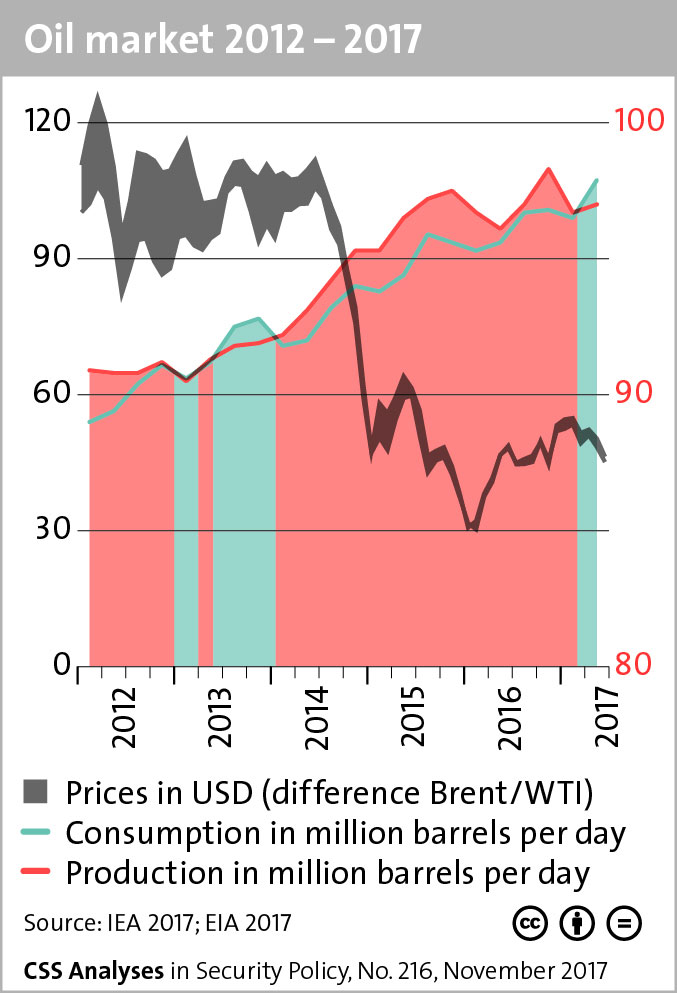

The coronavirus crisis has hit the Russian economy at one of the worst possible times. As this graphic illustrates, since 2014/15, it has been impacted by low oil prices and Western sanctions and has recorded only moderate growth rates over the past three years.

For more on how the coronavirus crisis is a strain on the Russian economy and constitutes a stress test for the popularity of the regime, read Jeronim Perović’s CSS Analysis in Security Policy here.