Asia’s rise as a locus of international financial and economic power only increases the need to better understand how changes in important structural factors impact security dynamics. In that context, the Institute for Defence Studies and Analyses held its 14th annual Asian Security Conference in New Delhi this month. The goal of the gathering, entitled “Nontraditional Security Challenges – Today and Tomorrow,” is “to capture the complex issues involved in Asia’s emergence as the new locus of international affairs in the 21st century and India’s emergence as a factor in the continent’s evolving economic, political and security dynamics.”

The IDSA, an ISN Partner, is an Indian think tank devoted to the study of global strategic and security issues. The organization is funded by the Indian Ministry of Defense, but functions autonomously. It has brought together academics, policy analysts, and officials from government and multilateral organizations, from various Asian countries as well as other parts of the world every year since 1999 to debate upon issues pertaining to Asian affairs.

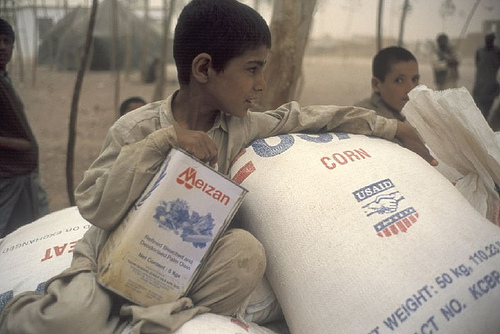

Opening remarks at the conference were made by IDSA Director General Dr. Arvind Gupta, with a keynote address by Shri Shivshankar Menon, the national Security Advisor to the Indian prime minister. A special address was given by Roza Otunbayeva, former president of the Republic of Kyrgyzstan. This meeting addressed the issues of water security, climate change, natural disasters, energy security, transnational crime, and financial and economic security. Each of these challenges has a related impact on food, water and energy resources, as well as implications for national economies and the movement of people, all of which fall between the short- and long-term and consequently are contributing factors to traditional security threats.

The IDSA is at the forefront of an effort to narrow the perception gap between about the relationship between non-traditional and traditional security issues. The hosting of this conference by an India-based organization is highlighted by the fact that India sits at the cross-roads of several important gateways to global power centers: including for energy, economic and trade hubs, sea lanes of communication, and maritime power. This point was highlighted by Ajit Doval in the closing plenary session of the 2011 ISF here in Zurich. Certainly in the case of Asia, the emergence of new threats and the changing context of regional security issues will increasingly become the centerpiece of policy and research agendas around the world.