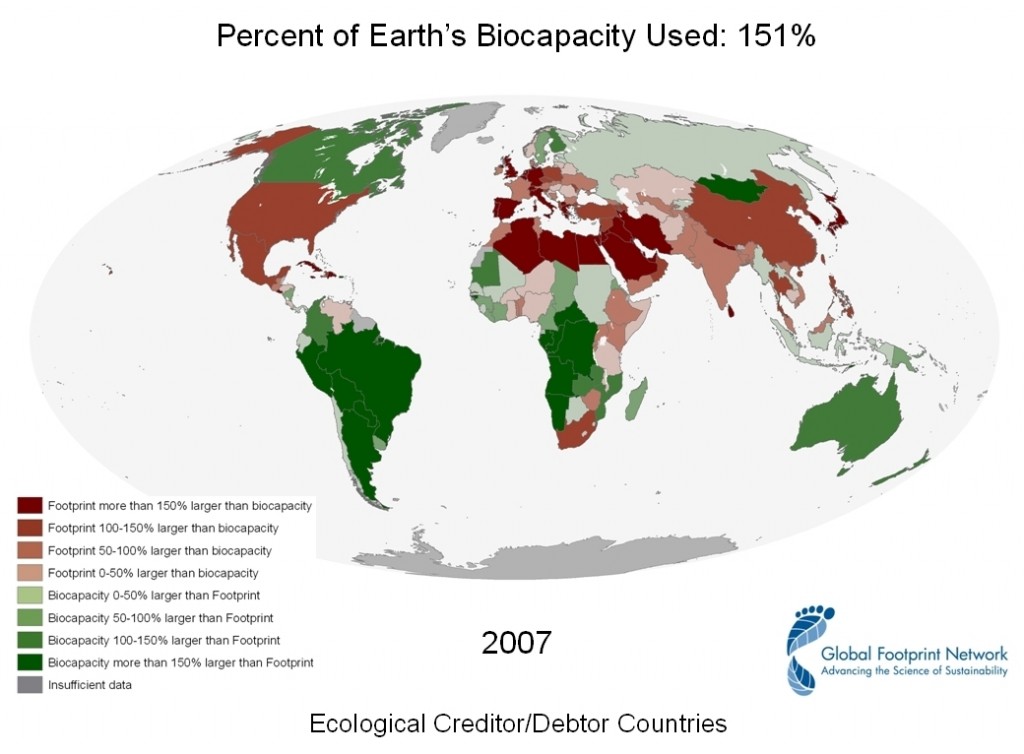

On Monday 6 February the ISN examined three different ways of thinking about development. High up on the international agenda are both human development and sustainable development. That makes sense. After all, those of us who are lucky enough to lead healthy and fulfilling lives still make up a minority of the world’s population. Too many people are trapped in conflict zones, live in fear of oppression, or do not even get a basic education. At the same time, climate change, resource depletion and environmental pollution have become serious security issues, and many would agree that effective measures to counter a number of worrying ecological trends need be implemented sooner rather than later.

But just how sustainable is human development? Well, as the following chart illustrates, until now it has not been sustainable at all. The chart plots countries’ HDI scores against their ecological footprint. The HDI score measures human development. The ecological footprint, which was explained in more detail in yesterday’s blog, tells us how many planets would be required if every person in the world wanted to have the same lifestyle as the average citizen in a given country: