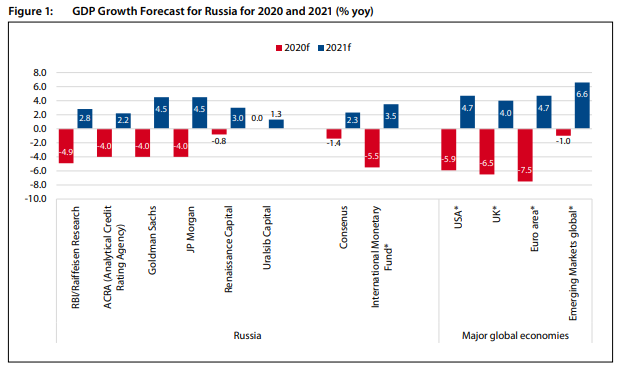

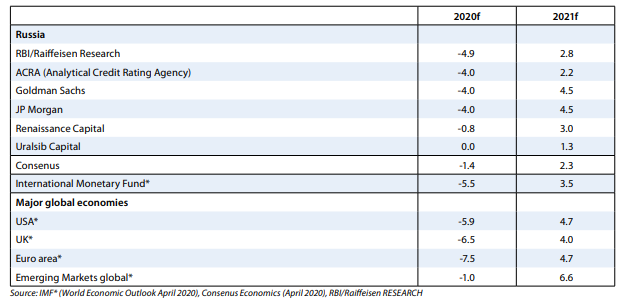

This graphic breaks down the GDP growth forecast for Russia in 2020 and 2021. Forecasts range from slightly negative values to -6 percent. The drastic economic consequences of the quarantine measures explain why 2020 GDP estimates for Russia are currently extremely divergent.

For more on how Russia is facing the economic crisis posed by the Covid-19 pandemic, see Russian Analytical Digest 251 on ‘Russia and the Covid-19 Pandemic’.